Cross-border remittance solution for regulated institutions and PSPs.

USDT–USD conversion with banking-grade compliance and global reach.

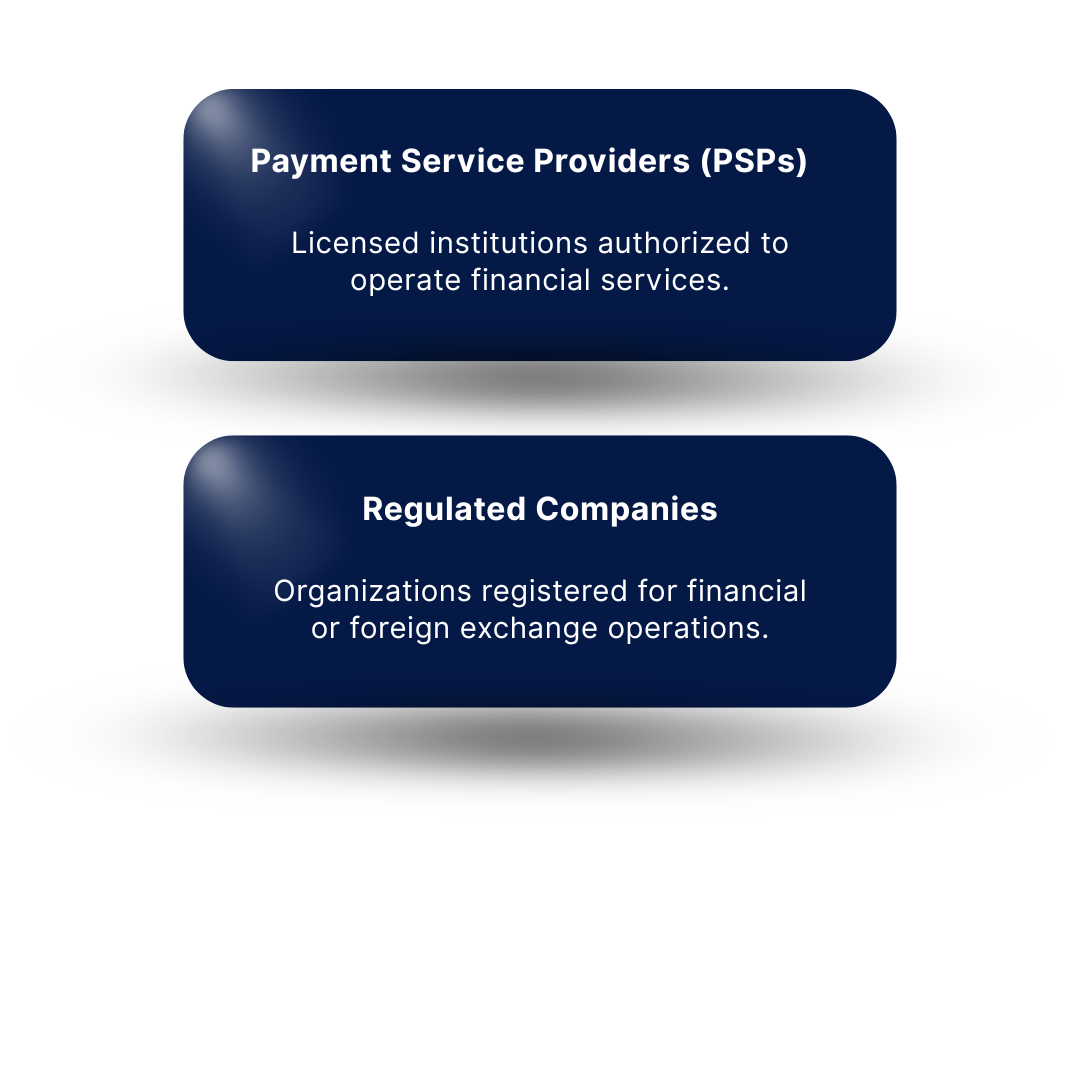

Operating Requirements

Who Can Use This Service

We work exclusively with regulated financial entities to ensure compliance, security, and operational transparency.

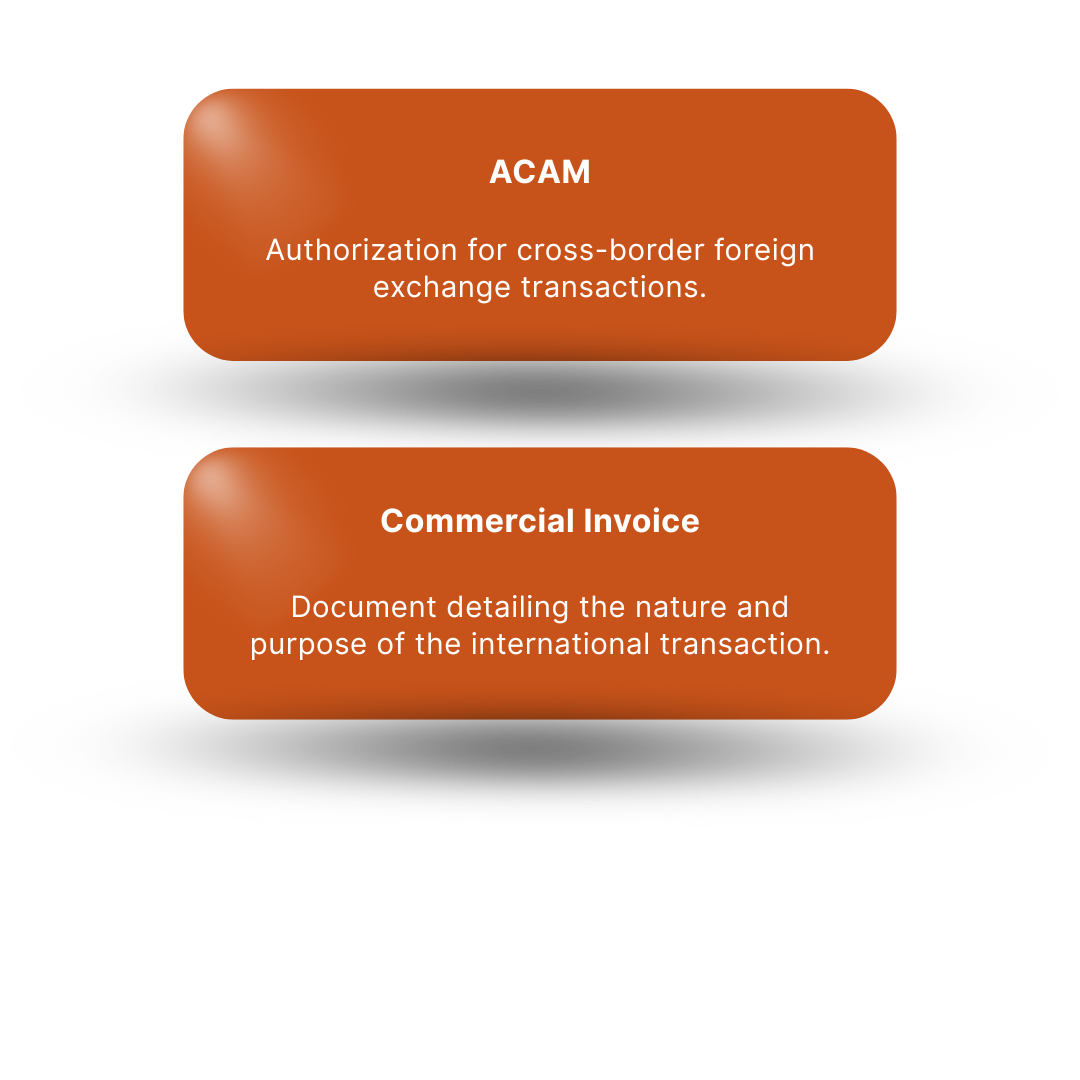

Documentation Required

To comply with the Central Bank and international standards, the following documents are needed:

Operational Model — Seamless Cross-Border Flow

How It Works

Our remittance model was designed for efficiency, transparency, and speed —

allowing funds to move seamlessly between Brazil and global markets.

Local Processing

Get paid instantly with the fastest PIX in Brazil and SPEI in Mexico. Speed, full transparency and zero bureaucracy.

Conversion & Settlement

Once confirmed, funds are converted into digital or fiat currency, depending on the route, and securely settled through our platform.

Delivery to Destination

Transfers are completed to the recipient’s wallet or bank account, ensuring traceability and full compliance with Central Bank requirements.

USD Settlement Routes

We offer two compliant settlement routes, depending on the operational needs of each partner.

Standard Settlement (D+1)

A next-day settlement route designed for regulated institutions that require FX processing and full compliance validation.

FX and compliance checks completed before settlement

USD delivered on the next business day

Full traceability and regulatory alignment

Instant Settlement (D+0)

A same-day settlement route for partners that need faster USD delivery with a streamlined operational flow.

Same compliance checks as Standard Settlement

Accelerated clearing and processing cycle

USD delivered instantly once approved

Ready to get started in Latam?

Connect your business to the main payment methods in Brazil and Mexico through a fast, secure, and fully compliant infrastructure. Gain real-time visibility, full operational control, and low technical complexity, all aligned with local regulations and requirements.